Apply for a Company Name

File an application for your business’ name as a Section 8 Company. You can get approval from the company SPICE + PART A Application procedure and then proceed with registration. Alternatively, you can reserve your company’s name through the SPICE incorporation. If the first name is rejected due to resemblance or an already existing name, one of the two alternative suggestions given will be chosen.

Prepare the forms and file the company incorporation documents with the MCA

These essential documents consist of a Simplified Proforma for Incorporating a Company (SPICE+), the Memorandum of Association, Articles of Association labeled as SPICE+ Part B, MoA, AOA, AGILE PRO S & INC 9 respectively. All the aforementioned need to be attested or executed along with the digital signatures of the directors and shareholders.

Processing of the Documents

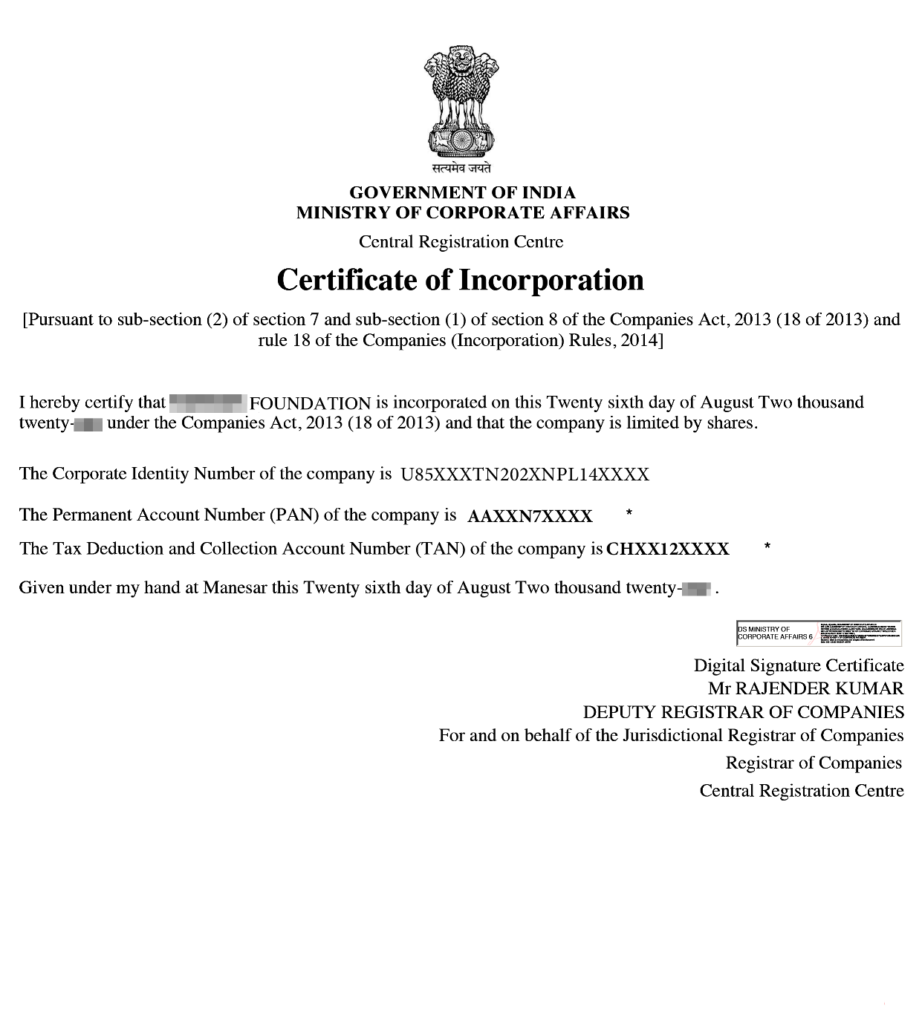

The Company Registration Centre or CRC will process these documents and duly approve of the registration, upon which the following will be issued:

- Certificate of Incorporation

- DIN allotment

- Mandatory issue of PAN

- Mandatory issue of TAN

- Mandatory issue of EPFO registration

- Mandatory issue of ESIC registration

- Mandatory issue of Profession Tax registration (Applicable States)

- Mandatory Opening of Bank Account for the Company and

- Allotment of GSTIN (if so applied for)