As per the Indian Partnership Act, 1932 the only requirement to start business as a partnership is the publishing and execution of a Partnership Deed between the Partners. This Act does not need the deed or firm to be registered. To put it simply, a Partnership Firm is not needed to be a registered Firm. You will come across various partnership businesses that exist as an unregistered partnership.

- Starting a New Business

Special Business Entities

- Intellectual Property

- Change in Business

Select Conversion Type

- Proprietorship to Partnership

- Proprietorship to LLP

- Proprietorship to Private Limited Company

- Proprietorship to OPC

- Partnership to LLP

- Partnership to Private Limited Company

- LLP to Private Limited Company

- OPC to Private Limited Company

- Private Limited Company to LLP

- Private Company to Public Company

- Registration & Filling

Tax Filing

- Accounting & Compliance

- Verify your Documents

- IT Services

- +9154847Xyz

- Info@registrationmantra.com

- Starting a New Business

Special Business Entities

- Intellectual Property

- Change in Business

Select Conversion Type

- Proprietorship to Partnership

- Proprietorship to LLP

- Proprietorship to Private Limited Company

- Proprietorship to OPC

- Partnership to LLP

- Partnership to Private Limited Company

- LLP to Private Limited Company

- OPC to Private Limited Company

- Private Limited Company to LLP

- Private Company to Public Company

- Registration & Filling

Tax Filing

- Accounting & Compliance

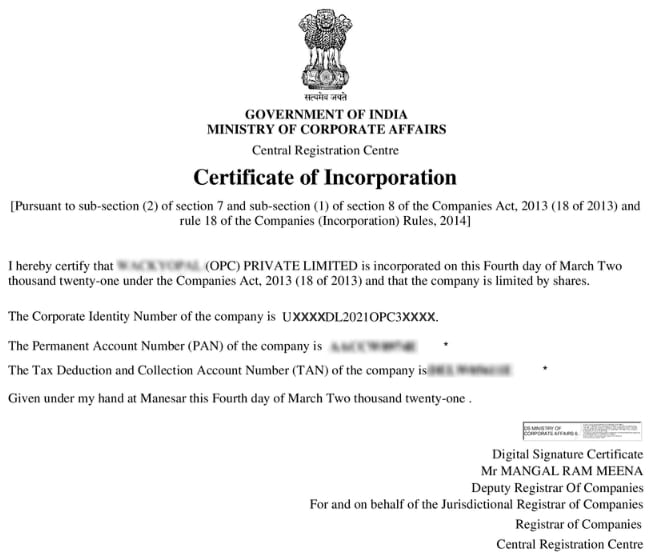

- Verify your Documents

- IT Services